Plugging Africa’s Energy Gap – with Gas

How gas can help to improve access to energy for communities in West Africa

Just Not Enough Electricity

The facts concerning the lack of electricity in Africa are shocking.

More than a century after the light bulb was invented, most of the African continent remains cloaked in darkness after nightfall. School children often cannot read after dusk, businesses cannot grow, clinics cannot refrigerate medicines or vaccines, and industries are left idle. This dire reality is hampering economic growth, affecting jobs, and limiting livelihoods. Outside of South Africa, power consumption averages 124 kilowatt-hours per person per year, or just about enough to power one light bulb per person for six hours a day. In Sub-Saharan Africa, only one fifth of the population has access to electricity compared with one half in South Asia and four fifths in Latin America.

To exacerbate matters, the slow rate of progress in electrification means that most African countries will fail to reach universal access to electricity even by 2050. The cost of producing power in Africa is about twice as expensive as elsewhere in the developed world. Moreover, the intermittent and unreliable nature of the available electricity has led to an over-reliance on inefficient, expensive, small-scale, oil-based back-up power generators that produce electricity that is even more expensive. It has been estimated that a spend of US$ 41 billion per year is needed to address these multiple and deep-seated problems.(1)

That there is a direct and important relationship between energy and economic growth is a modern axiom. According to the World Economic Forum: “Without heat, light, and power, you cannot build or run the factories and cities that provide goods, jobs, and homes, nor enjoy the amenities that make life more comfortable and enjoyable. Energy is the ‘oxygen’ of the economy and the life-blood of growth…”(2)

Of the forms of energy, the International Energy Agency (IEA) has stated: “Electricity demand growth in emerging economies remains strongly linked to rising economic output.”(3)

This is especially the case with Africa, where the largest infrastructure deficit is to be found in the power sector.(4) Whether measured in terms of generation capacity, electricity consumption, or security of supply, Africa’s power infrastructure delivers only a fraction of the service found elsewhere in the developing world.

The 48 countries of Sub-Saharan Africa (with a combined population of 800 million) generate roughly the same amount of power as that of Spain (with a population of 45 million).(5)

Akinwumi Adesina, who took over as president of Africa’s lead development lender, the African Development Bank, in September 2015, plans to dedicate his tenure to solving what he sees as the biggest hindrance to economic growth and development on the continent: the energy deficit.

Adesina has said that this flagship project aims to raise US$ 55 billion of investment to close the energy deficit in the next decade. According to the International Renewable Energy Agency (IRENA), the continent will need to add around 250GW of capacity between now and 2030 to meet growing demand which implies that capacity additions will have to roughly double to around 7GW annually.

Hopeful Signs

There has been considerable encouraging progress in some parts of Sub-Saharan Africa in bringing together neighbours to support collaborative efforts and responses. In the region of West Africa and for the 15 countries forming the Economic Community of West African States (ECOWAS), there is already a community of nations with aligned policies on key areas, including energy, along with good physical evidence of installed energy projects responding to the challenges. These projects include the West African Power Pool (WAPP), which distributes electricity among nations across the West Africa region, and the West African Gas Pipeline (WAGP), which transmits gas from Nigeria to Togo, Benin, and Ghana.

Penspen has recently worked with ECOWAS to study options to improve energy supply to the region and, through this study, has been at the forefront of assessing energy demand and supply issues as well as developing new concepts designed to radically improve the supply and diversity of energy.

Principally, our recent study has examined ways to expand the benefits from gas delivered by the WAGP system to each of the ECOWAS countries beyond those already connected, and to reach an additional 11 countries in West Africa, some of which are the poorest in the whole continent.

It is acknowledged that improvements to Africa’s supply of energy also need to try and address global issues affecting energy production. This means that when increasing energy supply, solutions need to embrace renewables alongside traditional responses that develop energy from other sources. Whilst there is a natural tension between renewables and traditional methods, there is great scope to advance both in a collaborative way that avoids a binary choice, which denies one the benefit of the other.

More Electricity but From What Source?

It is well documented that rising levels of Greenhouse Gas (GHG) emissions in the atmosphere are driving climate change.

Power generation plays a significant role as a source of GHG emissions. For example, in the United States, most of the emissions from human-caused (anthropogenic) GHGs come primarily from burning fossil fuels – coal, hydrocarbon gas liquids, natural gas, and petroleum – for energy use. In 2016, emissions of carbon dioxide (CO2) produced as a by product of burning fossil fuels for energy were equal to 76% of total U.S. anthropogenic GHG emissions (based on global warming potential) and about 94% of total U.S. anthropogenic CO2 emissions.(6)

The global rise in CO2 levels and temperatures has led to responses such as the Paris Agreement, whereby the central aim is to limit global temperature rise this century to well below 2 degrees Celsius above pre-industrial levels and to pursue efforts to limit the temperature increase even further to 1.5 degrees Celsius.

To meet their Paris Agreement commitments, governments have focused on achieving greater energy efficiency and using more low-carbon energy sources for electrical power generation. Policies targeting energy efficiency have been steadily increasing in recent years and have had significant impact. For example, globally 31.5% of final energy consumption was subject to mandatory energy efficiency policy in 2016, up from only 14% in 2000.(7)

Using natural gas in parallel with renewables can significantly reduce the carbon footprint of power generation, through both greater efficiency and lower emissions.(8) For example, natural gas-fired Combined Cycle Gas Turbine (CCGT) plants are a form of highly efficient energy generation technology that combines a gas-fired turbine with a steam turbine.

They generate about half of the amount of CO2 compared to burning coal to produce the same amount of energy. This, coupled with the greater efficiencies of these gas-burning electricity production plants, has led to dramatic declines in the use of coal-fired production.

CCGT plants work well alongside renewable power plants because of these benefits. Renewable power plants generate electricity supplies from wind, solar, and wave power, while CCGT plants provide a base load supply and take up the slack in energy production from these variable renewable sources.

The economics of this partnership are also positive. Taking account of the impacts of subsidies and the effects of carbon costs, CCGT energy costs compare well with those of renewables (based on a U.K. location) as shown in the following table.

| CCGT | Biomass Conversion | Offshore Wind | Large Scale Solar PV | Onshore Wind > 5MW | |

|---|---|---|---|---|---|

| Pre-Development Costs | 0 | 3 | 7 | 8 | 5 |

| Construction Costs | 9 | 7 | 95 | 68 | 57 |

| Fixed O&M | 3 | 8 | 31 | 12 | 13 |

| Variable O&M | 4 | 1 | 4 | 0 | 7 |

| Fuel Costs | 46 | 94 | 0 | 0 | 0 |

| Carbon Costs | 25 | 0 | 0 | 0 | 0 |

| Total $/MWh | 86 | 112 | 137 | 87 | 82 |

| Cost in $/kWh | 0.09 | 0.11 | 0.14 | 0.09 | 0.08 |

Levelised Cost Estimates for Projects Using Established Technologies Commissioning in 2020, Technology-specific Hurdle Rates, $/MWh[9]

Hence, in the debate about energy generation, the role of gas-fired CCGT will remain a critical resource providing reliable, efficient base load generation to support a full suite of renewable technologies.

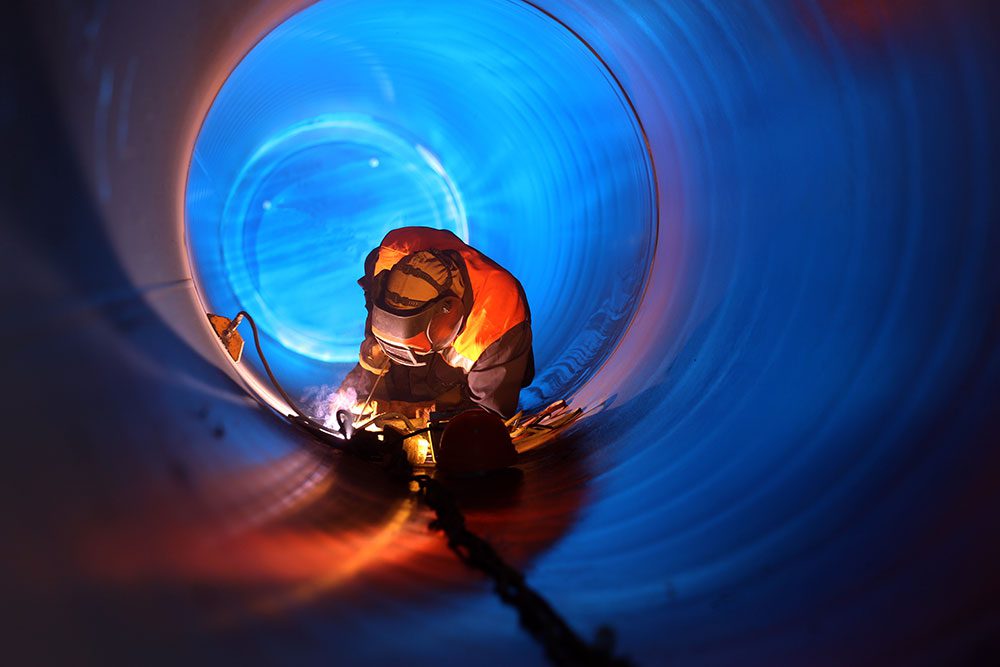

Getting Gas in Africa to Where it’s Needed

Africa is fortunate to possess an abundance of natural gas reserves. Indeed, substantial further reserves, such as the sizable discoveries offshore in Mozambique and Tanzania, have recently been added to the continent’s portfolio. In West Africa, the Greater Tortue field off the Senegal-Mauritania maritime border contains over 50Tcf of resource potential – split roughly in half between the two countries – and sufficient for 30-50 years of production.

This adds to the gas reserves of Nigeria, estimated at 184Tcf, the ninth largest in the world.10 Gas is therefore available in West Africa, but as a product it requires transportation by either pipeline or LNG to reach a market.

The work by Penspen for ECOWAS — supported by local Dar Group offices in the West Africa region — has studied the functioning and operation of the existing WAGP system, and considered where and how it could be expanded to reach the whole of the ECOWAS region not currently part of the WAGP.

There is potential to reach a further 11 countries with a combined population of over 240 million.

Penspen has researched, developed, and costed a concept for a gas system network of over 5400km that will reach these countries12 through an ambitious ring main pipeline network of up to 36” diameter. The promotion of a ring main concept means that the necessary compression requirements are minimised through efficient flow, and there are considerable benefits for security of supply where any interruption can be minimised by flow in the other direction. It also allows offshore gas fields to utilise a new mode of transportation and encourages the development of stranded or marginal fields.

Ultimately, the pipeline system will bring energy in the form of natural gas to regions which are energy poor. This will provide these countries with the feedstock for CCGT plants, enabling them to make a step towards change in the provision of electrical power. They will also be able to use natural gas as a feedstock for certain energy intensive industries, such as cement and fertiliser manufacturing, and to power transport through compressed natural gas (CNG).

All of these benefits offer great hope of mobilising significant economic growth in the region but are critically dependent upon having the energy to fuel it.

The development of such an energy system would bring direct employment for many during the lengthy construction phase and thereafter for operational and maintenance staff employed by the holding company. Studies on the use of gas in Sub-Saharan Africa have identified some of the key potential benefits likely to accrue, although it is acknowledged that there are also many contingent challenges. These are summarised in the following table:

| Application | Local Conditions Influencing Adoption of Gas-Fired Power |

|---|---|

| Replace Liquid Fuels | When liquid fuels are in use to generate baseload or mid-cycle electricity, gas from domestic production or pipeline imports is likely to offer significant cost savings. |

| When liquid fuels are used for peaking or backup generation, the viability of gas may depend on locating the peaking plant near the source of gas production. Otherwise, the cost of underused pipeline capacity could negate fuel cost savings. | |

| Using imported LNG to replace HFO or diesel is likely to be unattractive unless high utilisation rates can be achieved. | |

| For small, inland markets, pipeline gas is unlikely to be economic, and liquids replacement will depend on transmission grid capacity. | |

| Displace Coal | When gas at LNG export parity competes with coal at international prices, gas is often cheaper as a baseload solution, even without taking carbon into consideration. |

| When domestic coal prices are below international levels, the competitiveness of gas is likely to depend on its availability at less than international prices. This can make sense for a producing country when reserves are insufficient to support a LNG project, or when reserves exceed LNG requirements to such a degree that the opportunity cost of gas is driven down to petrochemical levels. | |

| The competitiveness of gas versus coal improves dramatically when strong carbon reduction policies are in place, through either self-imposed caps on emissions or the incorporation of carbon pricing into least-cost generation decisions. | |

| Gas competes very effectively against coal as a mid-cycle (e.g. 50% - 70% load factor) solution across a wide range of fuel prices. | |

| Complement to Hydropower | Even where abundant hydropower potential exists, and where they are the least-cost long-term generation option, gas-fired plants can be attractive: |

| - When hydropower will operate at mid-cycle load factors; | |

| - When implementation and drought risks in the hydropower program are high; | |

| - When the minimum efficient scale of hydropower greatly exceeds incremental market growth. |

Roles for Gas-to-Power in Sub-Saharan Africa[13]

The longer-term benefits of increasing the supplies of natural gas will be immense in providing, at last, a means to increase the availability of electricity, so that a population of 367 million people in West Africa will be able to switch on a lightbulb for longer than six hours a day and make a start to plugging the huge energy gap in Africa.

View the Dar Magazine article here.

(1) World Bank Group; Fact Sheet: The World

Bank and Energy in Africa.

(2) World Economic Forum; Energy for Economic

Growth – Energy Vision Update 2012; Energy:

The Oxygen of the Economy; Peter Voser;

Chief Executive Officer, Royal Dutch Shell.

(3) IEA; Global energy and CO2 status report –

2017.

(4) World Bank Group; Fact Sheet: Infrastructure

in Sub-Saharan Africa.

(5) World Bank Group; Africa Infrastructure

Country Diagnostic; ‘Fast Facts Energy’.

(6) U.S Energy Information Administration;

‘Where Greenhouse Gases Come From’.

(7) IEA; Global energy and CO2 status

report – 2017.

(8) A full discussion on the importance of the

role of natural gas in addressing the climate

change challenge can be found in our previous

article; “Supporting the Paris Agreement

Emissions gials” Darmagazine ( Issue 15)

https://dar.com/content/publications/

i15/#page/27.

(9) Notes:

1) Source of data – BEIS 2016 Electricity

Generation Costs, Table 2 (adapted).

2) Conversion used £/$ 1:1.3 for £/MWh

to $/ MWh.

3) CCGT using H Class GT;

4) Offshore wind – from U.K. Round 3;

Onshore wind – U.K. location.

(10) bp-stats-review-2018-natural-gas.

(11) The West African Gas Pipeline Company

limited (WAPCo); http://wagpco.com/

(12) Capo Verde subject to further study.

(13) Harnessing African Natural Gas; A New

Opportunity for Africa’s Energy Agenda?;

Energy and Extractives Global Practice; The World Bank.